The Governor of the Reserve Bank of India (RBI), Shaktikanta Das, has been conferred the Governor of the Year award for his role in cementing critical reforms, overseeing world-leading payments innovation and steering India through difficult times with a steady hand and well-crafted turn of phrase.

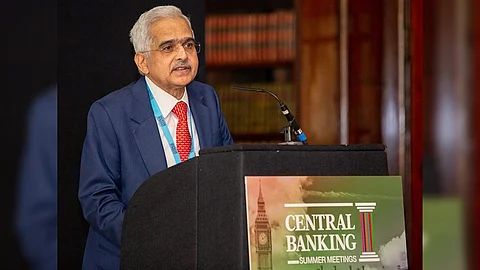

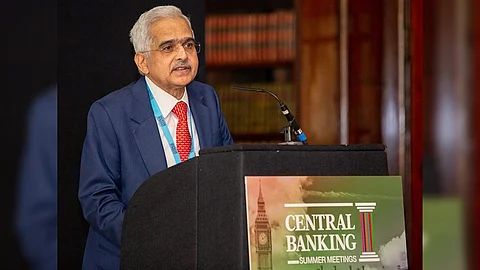

The Central Banking Awards ceremony in London this week followed a plenary address by India’s central bank chief on ‘Central Banking in Uncertain Times: The Indian Experience’. ‘Central Banking’, which is a respected authority on issues related to central banks and financial regulators worldwide, praised Das for his deft handling of the world’s fastest growing economy through critical times.

It said: “Covid had a devastating impact worldwide, and densely populated India looked particularly vulnerable. It was in managing this crisis that Das had perhaps his greatest impact, appearing as a voice of calm amid the fear, and steering the RBI deftly between intense political pressures on one side and economic disaster on the other.

“Covid-19 was no doubt the biggest crisis Das has faced so far as RBI chief. But his tenure, which began in December 2018, has been marked by a series of grave challenges, starting with the collapse of a major non-bank firm, moving through the first and second waves of the coronavirus, and then, in 2022, Russia’s invasion of Ukraine and its inflationary impact.”

In his plenary address at the event, Das noted how central banks are at the core of monetary and financial systems have been called to do “heavy lifting” well beyond their traditional mandate.

He said: “Central banks have navigated through unchartered waters during the three black swan events – the pandemic, the war in Ukraine and the unprecedented scale and pace of global monetary policy normalisation – all in the span of three years. More recently, central banks had to quickly change gears from providing stimulus to pandemic ravaged economies to battling inflation with all ammunition at their disposal.

MORE LIKE THIS…

“Even as the battle against inflation was ongoing, the banking turmoil in certain advanced economies (AEs) posed the awkward trade-off between financial stability and price stability. This extraordinary period of global turbulence has indeed been extremely challenging for central banks and central banking.”